Savings & Investments

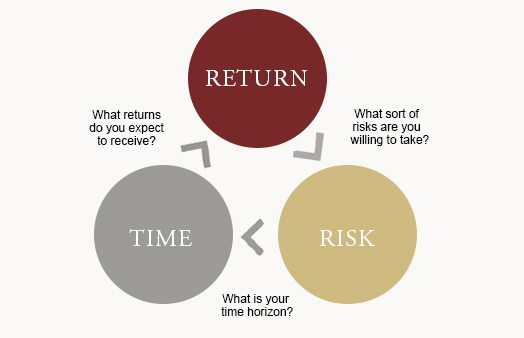

Investing money can be a daunting prospect, especially if you are new to investing. We use a step by step process which starts with assessing your goals and expectations, taking into account your tax situation, and finding out what level of risk you wish to take with your money. We use external resources to ensure we get the right mix of assets for you.

We are proud of the fact that we have attained investment qualifications to the highest level for Financial Advisers and can consider ourselves specialists based on the Personal Finance Society criteria.

You may have existing investments you wish to be reviewed. We can carry out ‘CPR’ on your investments where we will assess the Charges, Performance and Risk of your existing portfolio to ensure it matches your needs and expectations.

Our aim is to ensure that you understand how your investment works and we will recommend an investment strategy that is right for you.

With the most up to date technology, our clients can log into their own personal client site and view their investments 24/7. Gone are the days where you have to wait for the next anniversary statement to find out what your investment is worth!

Trustee Investments

We are one of only a few firms that transact Trustee Investments. This can be a complex area of advice, however, we have the experience and knowledge to help arrange this for you. We regularly receive referrals from professional trustees with clients who require this specific area of advice.

Do I Need to Invest?

Everybody needs cash and access to an emergency fund ideally no more than 6 months expenditure. Simply leaving your accumulated cash in a bank account can feel like the safe thing to do, but it is all too easy to forget about the ravages of inflation, meaning that your money has reduced buying power from one year to the next. The long term effect is staggering even on modest sums.

See more here: www.rateinflation.com/inflation-rate/uk-inflation-rate

In this short video Burton Malkiel – Professor of Economics at Princeton University explains the basic rules of investing:

Risk

Our objective is to provide the right balance of risk and reward to meet your objectives depending on whether your goal is to accumulate money for a specific event or if you have already accumulated money and need it to produce income.

Investment Principles

There is a tendency to invest too much in one thing such as Property, Cash or Company Shares.

Don’t put all your eggs in one basket!

Use different assets

Spread the Investments over the world

Invest in tax-efficient contracts such as pensions and ISA’s

Use good value funds

How We Do It

We have a step-by-step process which starts with assessing each individuals needs, followed by an investment risk assessment.

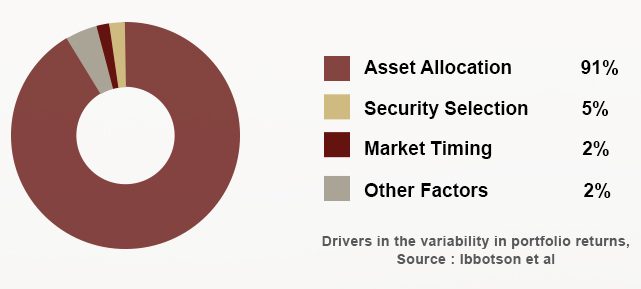

We use external research partners to make sure we get it right, lbbotson Investment Managers who recommend the correct mix of assets for each level of risk.

We help choose the investment manager and funds to construct the investment portfolio.

Ongoing Review

The most important part. We give you your own individual website which gives you access to your accumulated investments with up-to-date valuations, performance, spread of assets and the split between investments.

We like to review our clients investment portfolio’s on at least an annual basis to ensure they are still on track to meet their investment goals.

The Benefits

Potential for inflation beating returns

Cost conscious approach

Transparent Investment strategies

Management of risk

24/7 portfolio valuations

Academic investment ethos

Peace of mind